Automotive Wiring Harness Market Size, Share, and Forecast 2025-2033

Market Overview:

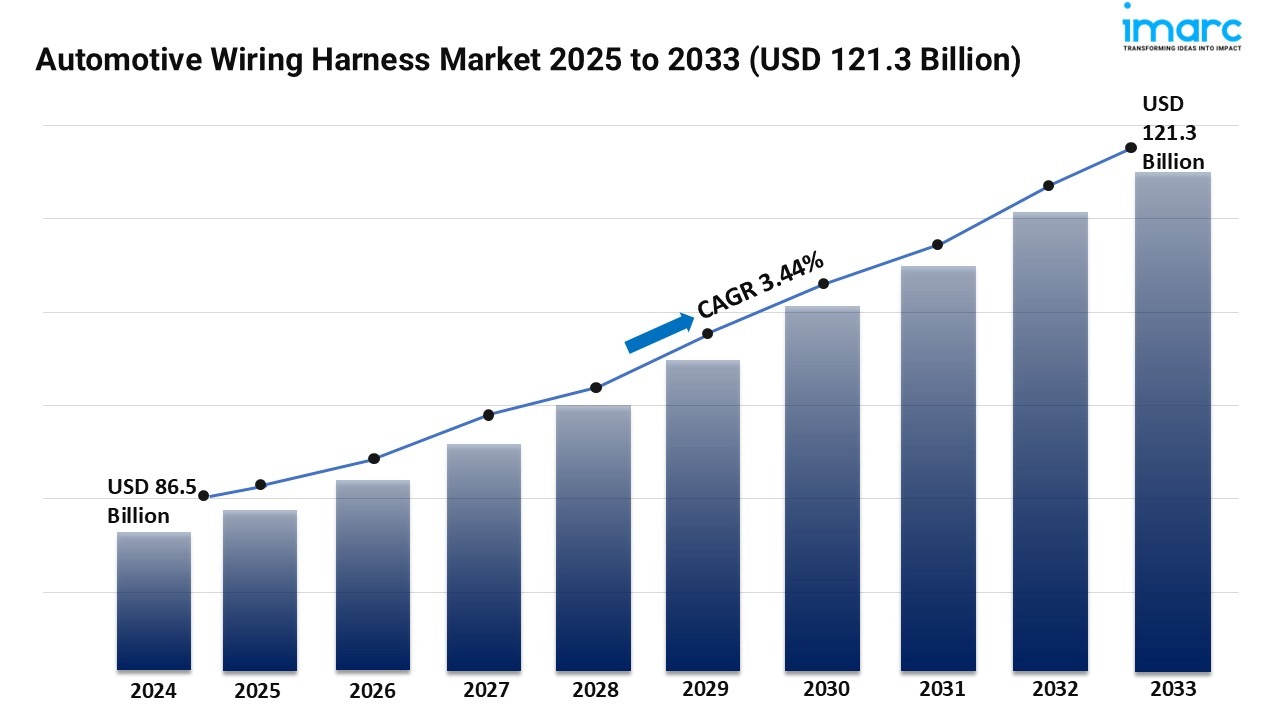

The automotive wiring harness market is experiencing rapid growth, driven by electrification complexity, advanced driver assistance, and miniaturization and lightweighting. According to IMARC Group’s latest research publication, “Automotive Wiring Harness Market Size, Share, and Trends by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, Region and Forecast 2025–2033”, The global automotive wiring harness market size was valued at USD 86.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 121.3 Billion by 2033, exhibiting a CAGR of 3.44% during 2025–2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/automotive-wiring-harness-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Automotive Wiring Harness Industry:

● Electrification Complexity

The rise of electric vehicles (EVs) is reshaping the automotive wiring harness market. EVs need complex wiring for high-voltage power that supports the battery, motor, and charging systems. They also require low-voltage circuits for lighting, infotainment, and safety. Manufacturers must create specialized high-voltage cables, connectors, and shielding for safety and to minimize electromagnetic interference.

The increasing number of sensors, actuators, and control units in EVs adds to the wiring's complexity. This leads to a strong demand for advanced wiring harness solutions that meet EVs' unique electrical needs. The shift toward electrification drives manufacturers to invest in new materials, designs, and processes to adapt to the automotive industry’s changing requirements.

● Advanced Driver Assistance

The rise of Advanced Driver-Assistance Systems (ADAS) and the move towards self-driving cars are increasing the need for high-performance automotive wiring harnesses. ADAS features, such as adaptive cruise control, lane departure warning, automatic emergency braking, and surround-view cameras, rely on sensors, control units, and communication systems. These systems require reliable wiring harnesses for effective integration and operation. As vehicles become more autonomous, the number and complexity of sensors and electronic parts will grow, raising the demand for advanced wiring harnesses. They must handle high data rates and ensure signal integrity. This trend calls for lighter, more flexible, and durable wiring harnesses to suit the intricate electronic setups of modern and future vehicles. This fuels innovation and growth in the market.

● Miniaturization and Lightweighting

The automotive industry seeks better vehicle efficiency and fuel economy. This creates a strong demand for smaller, lighter components, especially wiring harnesses. Lighter wiring harnesses improve fuel efficiency in combustion engine vehicles and help electric vehicles travel further. To meet this need, manufacturers must develop thinner wires and smaller connectors. They may also use materials like aluminum instead of copper.

As vehicles gain more electronic components, wiring harness designs must become more compact and efficient. This push for miniaturization and lightweighting brings challenges. Manufacturers need to ensure performance, durability, and reliability while making parts smaller. Consequently, there is a growing demand for innovative wiring harness designs, new materials, and improved routing methods. The automotive industry continues to strive for enhanced vehicle efficiency and performance.

Leading Companies Operating in the Global Automotive Wiring Harness Industry:

- Delphi Technologies (BorgWarner Inc.)

- Furukawa Electric Co. Ltd.

- Lear Corporation

- Leoni AG

- Nexans Autoelectric GmbH

- PKC Group Plc (Motherson Sumi Systems Ltd.)

- Samvardhana Motherson Automotive Systems Group B.V.

- Sumitomo Electric Industries Ltd.

- THB Group (AmWINS Group, Inc.)

- YAZAKI Corporation

- YURA Corporation

Automotive Wiring Harness Market Report Segmentation:

Analysis by Application:

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Chassis wiring harnesses dominate (34.9% share) due to critical role in powering ABS, suspension, and steering systems, amplified by lightweight material adoption for fuel efficiency.

Analysis by Material Type:

- Copper

- Aluminum

- Others

Copper leads (86.2% share) for superior conductivity and recyclability, driven by EV demand for high-voltage systems and sustainability mandates.

Analysis by Transmission Type:

- Data Transmission

- Electrical Wiring

Electrical wiring holds 81.5% share as backbone for EVs and ADAS, supporting high-voltage power needs and smart connectivity integration.

Analysis by Vehicle Type:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars lead (52.2% share) via high production volumes, tech integration (ADAS, infotainment), and EV transition requiring complex harness architectures.

Analysis by Category:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

General wires lead (40% share) for versatility in lighting/ignition systems, cost efficiency, and insulation advancements enhancing durability.

Analysis by Component:

- Connectors

- Wires

- Terminals

- Others

Wires dominate (42.2% share) as foundational elements for power/signal transmission, with innovations in aluminum alloys and heat-resistant materials.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific leads (37%+ share) due to manufacturing hubs, EV incentives, and cost-efficient supply chains bolstered by rising middle-class demand.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145

Post a comment